견적문의

페이지 정보

작성자 Ulysses Caringt… 댓글댓글 0건 조회조회 348회 작성일작성일 25-05-01 05:36본문

| 회사명 | XS |

|---|---|

| 담당자명 | Ulysses Carington |

| 전화번호 | MY |

| 휴대전화 | UL |

| 이메일 | ulysses_carington@yahoo.com |

| 프로젝트유형 | |

|---|---|

| 제작유형 | |

| 제작예산 | |

| 현재사이트 | |

| 참고사이트1 | |

| 참고사이트2 |

Outsourcing payroll duties can be a sound business practice, however ... Know your tax obligations as a company

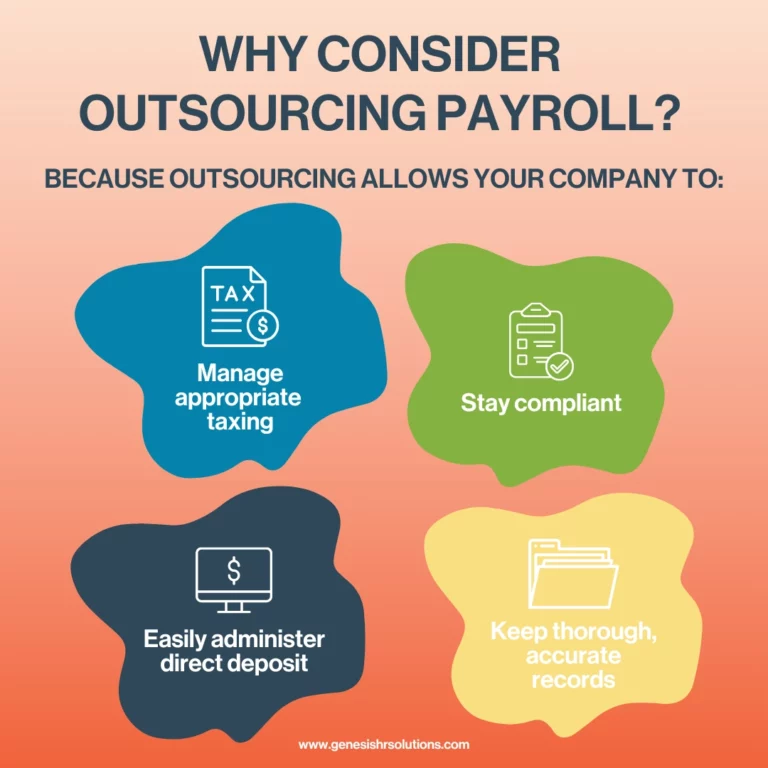

Many companies outsource some or all their payroll and related tax duties to third-party payroll service providers. Third-party payroll company can streamline company operations and help satisfy filing deadlines and deposit requirements. A few of the services they provide are:

- Administering payroll and work taxes on behalf of the employer where the employer offers the funds at first to the third-party.

- Reporting, gathering and transferring work taxes with state and federal authorities.

Employers who contract out some or all their payroll obligations should consider the following:

- The company is eventually responsible for the deposit and payment of federal tax liabilities. Although the company may forward the tax totals up to the third-party to make the tax deposits, the company is the accountable party. If the third-party fails to make the federal tax payments, then the IRS may evaluate penalties and interest on the employer's account. The employer is accountable for all taxes, charges and interest due. The employer might also be held personally accountable for specific overdue federal taxes.

- If there are any concerns with an account, then the IRS will send correspondence to the employer at the address of record. The IRS highly suggests that the company does not change their of record to that of the payroll company as it may substantially limit the company's ability to be notified of tax matters involving their business.

- Electronic Funds Transfer (EFT) must be utilized to transfer all federal tax deposits. Generally, an EFT is made utilizing Electronic Federal Tax Payment System (EFTPS). Employers must ensure their payroll providers are using EFTPS, so the companies can verify that payments are being made on their behalf. Employers ought to sign up on the EFTPS system to get their own PIN and utilize this PIN to periodically confirm payments. A red flag must increase the very first time a service company misses a payment or makes a late payment. When a company registers on EFTPS they will have on-line access to their payment history for 16 months. In addition, EFTPS allows employers to make any extra tax payments that their third-party company is not making on their behalf such as estimated tax payments. There have actually been prosecutions of individuals and business, who acting under the appearance of a payroll company, have taken funds meant for payment of work taxes.

EFTPS is a secure, precise, and simple to utilize service that offers an immediate verification for each transaction. This service is provided totally free of charge from the U.S. Department of Treasury and allows employers to make and verify federal tax payments digitally 24 hr a day, 7 days a week through the web or by phone. To learn more, companies can enlist online at EFTPS.gov or call EFTPS Customer care at 800-555-4477 for a registration type or to talk to a customer care representative.

Remember, employers are ultimately accountable for the payment of income tax withheld and of both the employer and employee portions of social security and Medicare taxes.

Employers who think that a costs or notice gotten is an outcome of an issue with their payroll provider must call the IRS as soon as possible by calling the number on the expense, writing to the IRS workplace that sent out the costs, calling 800-829-4933 or checking out a local IRS office. For additional information about IRS notices, expenses and payment choices, describe Publication 594, The IRS Collection Process PDF.